CISI – Wealth and Investment Management

Course Description:

Wealth and Investment Management – (ICWIM)

The International Certificate in Wealth & Investment Management course covers the essentials of financial planning, private client asset management, fund management, advisory functions and investment analysis from a global perspective. This program will ensure that you understand the range of assets and investment products that are available in the market and find appropriate solutions to meet the investment, retirement and protection planning needs for your clients.

| Chapter No. | Areas Covered | Weights(%) |

| 1 | The Financial Services Sector | 10 |

| 2 | Industry Regulation | 9 |

| 3 | Asset Classes | 9 |

| 4 | Collective Investments | 8 |

| 5 | Fiduciary Relationships | 19 |

| 6 | Economics & Investment Analysis | 15 |

| 7 | Investment Planning | 15 |

| 8 | Lifetime Financial Provision | 15 |

Visit Chartered Institute of Securities and Investments (CISI) to learn more about Global Institute

Who should study for ICWIM?

ICWIM is ideally suited for staffs working in wealth management roles, which need to demonstrate competence through the achievement of a benchmark qualification and who want to develop an understanding of how to deliver wealth management advice. It is also a very well established qualification that can help students, and aspiring professionals looking to make a career in wealth management domain.

Idealy suits for:

- New entrants to the financial services and insurance industry

- Professionals in banking and insurance sectors

- Who may be interested in diversifying into wealth management.

- Firms wanting to provide high-quality advice – Staff induction programmes

Eligibility to study ICWIM

It is recommended that a prospective candidate should have a reasonable exposure to wealth management

How is the qualification structured?

International Certificate and Wealth and Investment Management can be taken as a stand-alone qualification as well and the following options are available for the candidates completing the programme;

- CISI membership – Upon successful completion of the ICWIM you will be eligible to become an Associate member of the Institute and will be entitled to use the designatory letters, ACSI.

- Higher level qualifications – International Certificate in Advanced Wealth Management (ICAWM)

- Chartered Wealth Manager Qualification – the qualification offers wealth managers (including discretionary portfolio managers, private bankers, IFAs and others dealing with high net worth clients) a postgraduate level specialist qualification encompassing the breadth of knowledge needed to provide a high quality service to clients.

How is the examinations structured?

The assessment is a computer based examination which can be taken at the CISI’s computer based test (CBT) centre in Colombo.

- Two-hour paper

- 100 multiple-choice questions

- Pass mark of 70%

- Results will be provided immediately

Examinations can be taken at your convenience, after the completion of the programme.

Simply send us your details, we will get back to you with more information.

Or just call us, our programme coordinators will guide you through!

Certificate in Wealth and Investment Management (ICWIM)

Growing prosperity is increasing the demand for private banking services, whilst the turmoil in the financial markets demonstrates the need for robust and focused solutions to help clients withstand market volatility and preserve their wealth.

ICWIM covers the essentials of financial planning, private client asset management, fund management, advisory functions and investment analysis from a global perspective. You will learn about the range of assets and investment products available in the market and gain the knowledge to provide financial advice and find appropriate solutions to meet the investment, retirement and protection planning needs for your clients.

- The Financial Services Industry – The function of the financial services industry, macroeconomics analysis, microeconomic theory and financial markets.

- Industry Regulation – Financial services regulation, financial crime and corporate governance.

- Asset Classes – Cash, property, bonds, equities, derivatives and commodities.

- Collective Investment – Investment funds and other investment vehicles.

- Fiduciary Relationships – Fiduciary duties, advising clients and determining client need.

- Investment Analysis – Calculating statistics, financial mathematics, fundamental and technical analysis, yields and ratios and valuations.

- Investment Management Investment services, investment funds, other investment vehicles including structured investment funds, hedge funds, private equity, commodity funds and sukuk investments, risk and return, portfolio construction theories, investment strategies and performance management.

- Lifetime Financial Provision – Retirement planning, protection planning, estate planning and trusts, business tax, personal tax and overseas taxation.

Key Features

- Prepare for a career in wealth management – ICWIM provides a comprehensive introduction to financial planning, industry regulation, investment analysis and lifetime financial provision

- First step in the CISI’s wealth/retail pathway – you can build upon this qualification by progressing to higher level CISI wealth/retail qualifications

- Available to all – the qualification has no entry requirements

- Globally focused – provides knowledge of the key wealth management principles without focusing specifically on one jurisdiction

- Free CISI Student membership – become associated with a Chartered professional body and take advantage of an extensive range of benefits

- ACSI designatory letters

Who should study for Certificate in Wealth and Investment Management?

- The qualification’s broad focus on wealth and investment management makes it suitable for a wide audience – from new entrants to financial services to professionals already working in the industry who may be interested in diversifying into wealth management.

- It is an ideal alternative for staff working in wealth management roles who need to demonstrate competence through the achievement of a benchmark qualification and who want to develop an understanding of how to deliver wealth management advice.

- The ICWIM meets the needs of those firms who want to ensure that staff are able to provide high-quality advice and the qualification can be included into staff induction programmes.

How is the examinations structured?

The assessment is a computer based examination which can be taken at the CISI’s computer based test (CBT) centre in Colombo.

- Two-hour paper

- 100 multiple-choice questions

- Pass mark of 70%

- Results will be provided immediately

Examinations can be taken at your convenience, after the completion of the programme.

Academy of Finance Study Programme

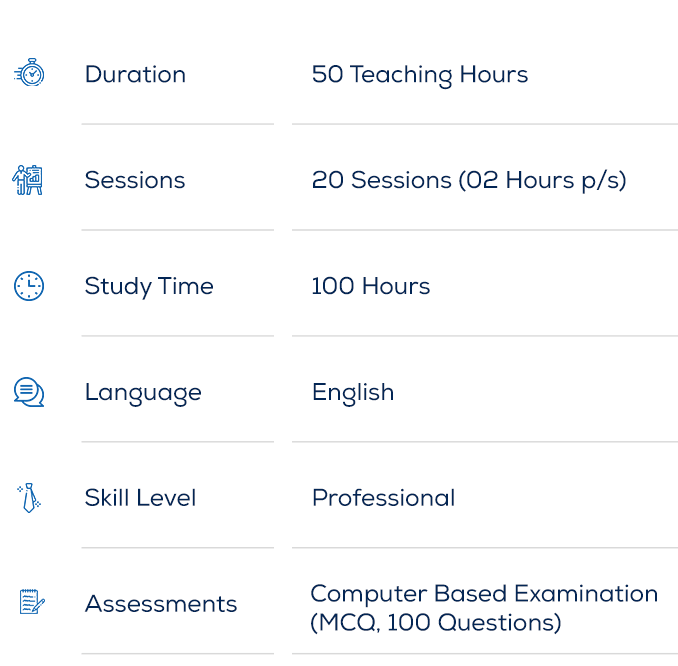

Academy of Finance provides a comprehensive teaching programme covering 50 teaching hours in 20 three hour study sessions. This includes the core material coverage, guest lectures and comprehensive revision sessions. Estimated additional study time will be 100 hours.

Classes will be staring on the 27th October and held on Tuesday from 7.00 pm to 9.30 pm at Academy of Finance Premises.

Entry Qualifications

It is recommended that a prospective candidate should have a reasonable exposure to wealth management.

Next Step – After completion

- CISI membership – Upon successful completion of the ICWIM you will be eligible to become an Associate member of the Institute and you will be entitled to use the designatory letters, ACSI.

- Higher level qualifications – International Certificate in Advanced Wealth Management (ICAWM)

- Chartered Wealth Manager Qualification – the qualification offers wealth managers (including discretionary portfolio managers, private bankers, IFAs and others dealing with high net worth clients) a postgraduate level specialist qualification encompassing the breadth of knowledge needed to provide a high quality service to clients.