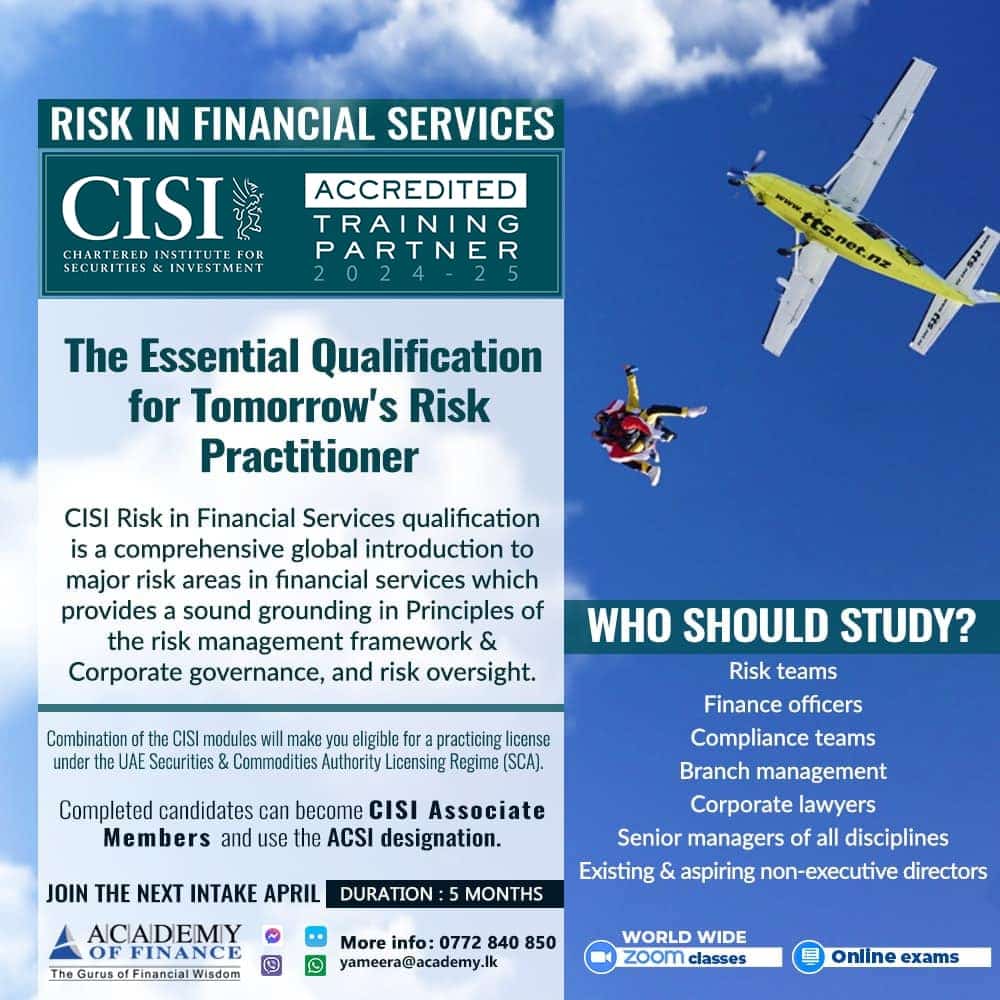

CISI – Risk in Financial Services

Course Description:

Risk in Financial Services

CISI’s Risk in Financial Services qualification is a comprehensive global introduction to all the major risk areas in financial services which provides a sound grounding in Principles of the risk management framework & Corporate governance and risk oversight.

The qualification also covers specific techniques used in identifying, reducing and managing specific risks in the following areas:

- Operational risk

- Credit risk

- Market risk

- Investment risk

- Liquidity risk

Visit Chartered Institute of Securities and Investments (CISI) to learn more about Global Institute

Who should study for Risk in Financial Services?

The Risk in Financial Services qualification has been developed to provide candidates with a broad understanding of the key risks that arise specifically within the financial services industry and is particularly aimed at:

- Risk teams

- Compliance teams

- Branch management

- Corporate lawyers

- Finance officers

- Senior managers of all disciplines

- Existing and aspiring non-executive directors

How is the qualification structured?

Risk in Financial Services can be taken as a stand-alone qualification and upon completion the candidate will get the Associate of The Chartered Institute of Securities and Investments (ACSI) status.

It can also be taken with one of the following exams:

- UK Financial Regulation

- Local regulatory paper (for international candidates)

Upon successful completion of Risk in Financial Services and one of the above regulatory papers, candidates will be awarded the Certificate in Risk in Financial Services. The Risk in Financial Services exam also qualifies as an IOC technical unit.

How is the examinations structured?

The assessment is a computer based examination which can be taken at the CISI’s computer based test (CBT) centre in Colombo.

- Two-hour paper

- 100 multiple-choice questions

- When in doubt candidate can flag the questions to review later if time permits

- Pass mark of 70%

- Results will be provided immediately

- Average pass rate of 60%

Simply send us your details, we will get back to you with more information.

Or just call us, our programme coordinators will guide you through!

More information on Risk in Financial Services

(Level 3 Award In Risk in Financial Services)

Why study Risk in Financial Services?

Risk in Financial Services offers a comprehensive global introduction to the major risk areas in financial services. It addresses international issues, reflecting the needs of a worldwide market, and provides a sound grounding in the principles of the risk management framework, corporate governance and risk oversight. It covers specific techniques used in identifying, reducing and managing operational risk, credit risk, market risk, investment risk and liquidity risk.

Is Risk in Financial Services right for me?

Risk in Financial Services is suitable for risk and compliance teams, branch management, corporate lawyers, finance officers, senior managers of all disciplines and existing and aspiring non-executive directors.

Key features:

- Specialist qualification – covers a range of risks in financial services and can be taken as a stand-alone qualification or as part of the Investment Operations Certificate (IOC)

- Offers a progressive study pathway – Risk in Financial Services is one of the first steps in our compliance qualifications study pathway and offers access to the higher level Diploma in Investment Compliance

- Combine it with a CISI regulatory exam to complete the full Certificate in Risk in Financial Services. You are exempt from the regulation paper if you have already achieved a regulatory paper through another route, such as the IOC

- Free CISI Student membership – become associated with a Chartered professional body and take advantage of an extensive range of benefits

- Access to Associate membership and ACSI designatory letters