International Accountants Day and Future of Accountants

Did you know that 10th of November was the date chosen as the International Accounting Day because it was on this day in 1494 when the “Summa de Arithmetica, Geometria, Proportioni et Proportionalita“, the very first record on double entry book-keeping that laid the foundation for future works on business accounting, was published.

International Accounting Day

The first official celebration of Accounting Day was held as an event in the year 1972. Four years later, in 1976, other professional organizations were invited to participate in this event, which soon came to be renamed as “Accounting Day”. The main purpose of Accounting Day at present, is to promote the accounting profession.

It’s an opportunity to recognise the great work accountants do to make businesses thrive, support the economy, and help navigate people through the complexities of finance.

Accounting or Accountancy is the job of sharing financial information about a business to managers and shareholders with an interest in the business to help the decision-making process. This information is like a map of an organization which helps the decision makers determine where they are, where they were, and where they will go. Similar to the measure of distances by miles or kilo meters, accounting measures the activities of an organization according to the amounts of money associated with these activities.

Brief Historical Perspective

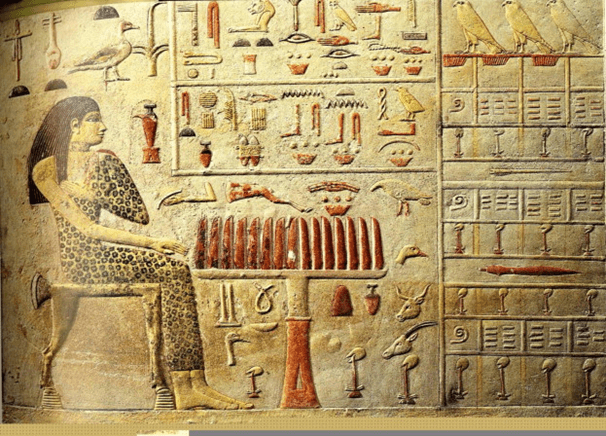

Examining the history of accounting is important because it provides a good foundation on which to develop and understand of the future of the discipline. Accountancy is very old. It started when humans first started to farm and form towns and cities. People who thought about economics, keeping track of money and valuable things, thought of a way to write down the sizes and values of crops.

Examining the history of accounting is important because it provides a good foundation on which to develop and understand of the future of the discipline. Accountancy is very old. It started when humans first started to farm and form towns and cities. People who thought about economics, keeping track of money and valuable things, thought of a way to write down the sizes and values of crops.

- Earliest forms

The earliest accounting records were found among the ruins of ancient Babylon, Assyria and Sumeria, which are more than 7,000 years old. The people of that time relied on primitive accounting methods to record the growth of crops and herds.

Because there is a natural season for farming and herding, it is easy to count and determine if a surplus had been gained after the crops had been harvested or the young animals weaned.

- Middle ages

In the twelfth-century A.D., the Arab writer, Ibn Taymiyyah, wrote a book called Hisba. This book has details about accounting systems that were used by Muslims before the mid-seventh century A.D.

Muslim accounting was influenced (changed) by Romans and Persians. In his book, Ibn Taymiyyah gives details of a complex governmental accounting system.

- Modern accountancy

Luca Pacioli (1445–1517) is said to be the “Father” of accountancy. He wrote a textbook in Latin called “The Sum of Arithmetic, Geometry, Proportions and Proportionality”. It has the first printed description of how merchants from Venice kept their accounts.

Merchants from Venice used a system called the double-entry bookkeeping system.

Future of Accounting

Technology, globalization and demographic trends continue to disrupt organizations, complete industries and indeed the working world as a whole. The role of the finance function will increasingly be brought into question.

Technology, globalization and demographic trends continue to disrupt organizations, complete industries and indeed the working world as a whole. The role of the finance function will increasingly be brought into question.

A function which was once a predominantly that of a reporting function focusing on balancing the books, will become a data-driven decision-center. Technology will play an increasingly significant role in executing many traditional finance tasks while at the same time generating greater insight.

Meanwhile, finance people will need to spend a greater proportion of their time working with colleagues across the organization to make decisions in support of the strategy.

Challenges for the CFO

Emerging challenges for the new generation CFO are twofold;

- Advances in new technologies

In-memory computing, the cloud, analytics, mobility, artificial intelligence (AI), blockchain and robotic process automation (RPA) — offer CFOs an exciting opportunity to reimagine what the accounting function should look like.

- People

CFOs must make bold moves to build a finance function that has the right people, with the right skills, to complement and get the most out of new technologies. Success of a CFO will depend on combining the intelligence of smart technologies with the brains, emotional intelligence and interpersonal skills of talented people.

The technologies transforming the finance function

Technology provides finance functions with many opportunities to do things better, but it also changes the business context in which finance operates. The rapidly increasing impact of digital technologies and computing on the finance function requires new competencies from finance professionals;

Technology provides finance functions with many opportunities to do things better, but it also changes the business context in which finance operates. The rapidly increasing impact of digital technologies and computing on the finance function requires new competencies from finance professionals;

- Advanced data analytics

- Robotic process automation (RPA)

- Cloud and Software-as-a-service (SaaS)

- Artificial intelligence (AI)

- Blockchain

Accounting has evolved from manual ledgers to computerized systems, ERP’s and now digitization and AI. How accountants adapt to the use of technology and cater to requirements for information, big data analytics and forecasting will define the successful next-gen accountant.