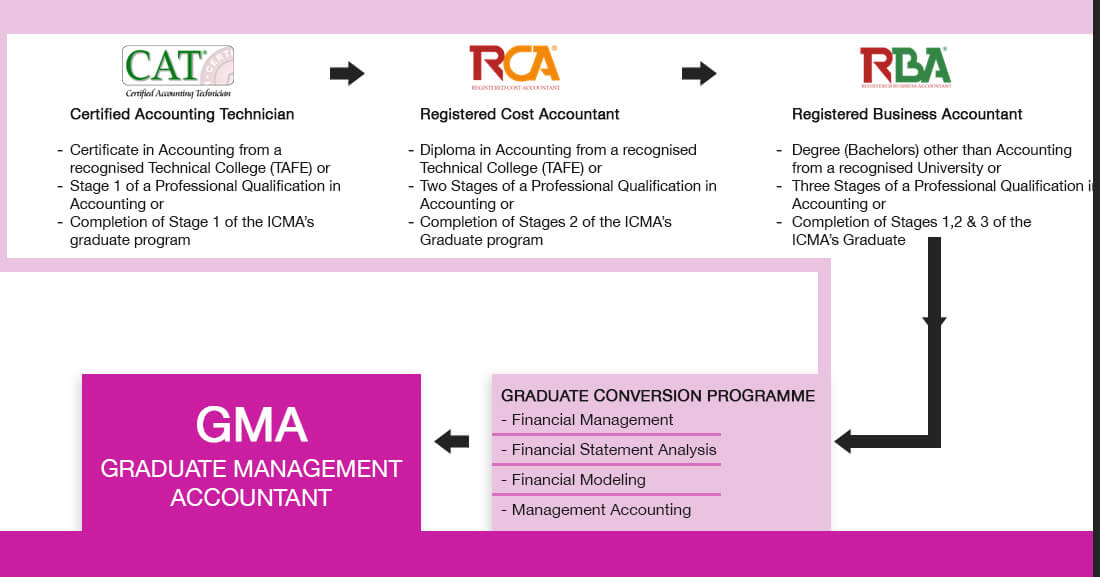

GMA – Graduate Conversion Programme

Programme Description:

Graduate Conversion Programme

Graduate Management Accountant (GMA) and Associate Management Accountant (AMA) Membership can be obtained by completing a Degree in accounting or MBA at a recognised university, or by completing the Graduate Conversion Program of the ICMA.

There are four stages in the Graduate Management Accountant programme, each stage requiring the passing of four subjects.

.

Stage Four of the graduate program consists of the totality of the subjects in the Graduate Conversion Program. These subjects may be undertaken directly (without completing Stages one to Four) by degree holders or professional qualifications in disciplines other than accounting. These subjects are taught at the honours/masters level.

Students completing Graduate Conversion Programme immediately apply for Graduate Management Accounting (GMA) membership of the ICMA and could apply for Associate Management Accountant (AMA) membership once they have achieved the three years experience required by the Institute.

Who should study for Graduate Conversion Programme?

University Degree or Professional Qualification

If you have a Degree from a government university/recognised foreign university or an acceptable professional qualification, you will have access to ICMA Graduate Conversion Programme.

- Subjects to be taken – All four subjects

- Duration – One Year (Maximum)

Part Completed Accountancy Qualification

If you have an acceptable part completed accountancy qualification you may get access to ICMA Graduate Conversion Programme.

- Subjects to be taken – Up to four subjects

- Duration – One Year (Maximum-if eligible)

MBA or Equivalent Postgraduate Qualification

If you have a Masters in Business Administration Degree or an equivalent qualification from a government university/recognised foreign university, you will have access to ICMA Graduate Conversion Programme.

- Subjects to be taken – Two to three subjects of Graduate Conversion Programme

- Duration – Six Months (Normal)

How is the qualification structured?

The final stage of the four stage ICMA (Australia) Education programme is considered as the Graduate Conversion Programme because it is offered as a separate entry path for Graduates, Postgraduates and Qualified Professionals.

Complete Graduate Conversion Programme comprises of four subjects. The specific subject combination to be completed will depend on the candidates’ qualifications at the entry point.

- Graduate Conversion Programme will make them eligible to apply for the Graduate Management Accountant and or Associate Management Accountant Membership.

- Alternatively the graduates are qualified to follow the CMA Seven Day Qualifying Workshop and apply for CMA (Australia) Membership.

How is the examinations structured?

Candidates should fulfil the mandatory attendance requirement, in order to be eligible to sit for the examinations.

Complete registration process is handled by the Academy of Finance.

- Final grading will comprise of the three hour open book examination and the group assignment completed during the course.

- Final Examination will be given 60% weight and the assignment will be given 40% weight in the final grading.

- Candidates should obtain minimum 50% grading mark and 50% examination marks in order to be successful at the examination.

Examinations will be conducted at the Academy of Finance premises or an alternative venue to be decided by the Academy of Finance.

Simply send us your details, we will get back to you with more information.

The complete qualification programme is structured, in 04 staged programmes which students should have to follow and complete all 04 subjects or few subjects according to their existing qualification.

Or just call us, our programme coordinators will guide you through!

Executive Summary

On completion of this subject, the students should be able to appreciate the role of computers in modelling and analysing the financial activities of a business and in decision support; appreciate the problems involved in the implementation of computerised financial models and spreadsheets; recognise the ways in which computer-based financial models may be used by management and evaluate commercially available financial modeling software.

Synopsis

Apply accounting principles and techniques to the model in all kinds of organisations

- Analyse and critically evaluate information for cost ascertainment, planning, control and decision making.

- Model and interpret financial accounting, cost accounting and other financial statements.

Weekend-Saturday

July 2025

Executive Summary

On completion of this subject, the students should be able to understand the decision making requirements and the information needs of management; apply management accounting principles and techniques to a wide range of situations in both service and manufacturing industries; appreciate recent developments in the theory and practice of management accounting, control systems; and appreciate the developments information technology in relation to the provision of management accounting information.

Synopsis

- Select and utilise control systems which provide management control of the organisation.

- Provide management with appropriate information for control, assessing and reporting on performance, monitoring efficiency, effectiveness and value for money.

Weekend-Saturday

July 2025

Executive Summary

This subject seeks to describe and explain the properties of financial statement numbers, the key aspects of decisions that use financial statement information, and the features of the environment in which these decisions are made.

Synopsis

- Understand the demand and supply forces of corporate financial disclosure.

- Apply analytical techniques such as common-sized statements and ratio analysis.

- Consider accounting method choice on accounting numbers.

- Undertake correlation and cross-sectional analysis of Financial Statements.

- Consider the impact of times series properties of financial statement numbers.

Weekend

Weekday

July 2025

July 2025

Executive Summary

On completion of this subject students should be able to apply capital budgeting principles and techniques to investment proposals in order to facilitate optimum decision-making, understand the risk/return trade-off inherent in portfolio analysis and selection; understand how to apply techniques suitable for valuing various debt and equity securities; examine and evaluate empirical research relating to the optimum financial structure of the firm; understand the nature, purpose and limitations of financial ratios and other data to evaluate performance and credit risks; examine and understand empirical research relating to the concept of market efficiency; examine and evaluate empirical research relating to the optimum dividend policy of the firm.

Synopsis

- Find, use, and manage funds in different organisations.

- Select and evaluate techniques used in treasury management and investment decision making.

- Analyse the changing, competitive business environment in order to formulate financial strategy.

Weekend

Weekday

July 2025