Funding Manufacturing Post COVID-19: A National Security Issue

Sometimes you may get what you wished for, but it could turn out to be a can of worms!

The $60B JobKeeper ‘Windfall’ – Best Used to Boost Local Manufacturing Capabilities

It is good to be right; even if it’s for the wrong reasons! In my article entitled, “Financial Modelling Wars: COVID-19 vs. the Economy”, published on March 31, 2020, I said that the government could save at least $65 Billion in worker-support costs if certain immediate actions were taken. It has now come to pass that this is almost exactly the savings that the government will benefit from, due to a large reporting error in estimates of the number of employees likely to access the JobKeeper program.[1]

Of course, my reasoning was based on management accounting cost calculations rather than a self-reporting error by 1000’s of Australian businesses.[2] I suggested that by boosting the number of ICU beds and offering financial incentives to home stay/isolate during the ‘peak’ for 2 months will enable the Australian economy to come out of hibernation about a month after the peak in about 3 months; rather than the then projected 6-months of isolation. It is a fact that ICU bed capacity was indeed boosted by all Australian States, especially Victoria; and that in 3 months since the start of the ‘lockdown’, i.e. by the end of June, all Australian States expect to come back to a semblance of normality.

In that March 2020 article, I also said that based on all the epidemiological and economic modelling that was made available to the public by the Federal government at that time, that “Australia is flying blind”. It has now come to pass that Australia was not flying completely blind, but with severely faulty instrumentation – which ultimately resulted in an A$60 Billion, decision error. This was, thankfully, an error in the Government’s favour, that now has many interest groups lobbying for a piece of that extra JobKeeper funding pie.

Special Interest Groups Lobbying for a Piece of the Action.

This brings us to the discussion on how best to spend the A$60 Billion ‘windfall’.

Companies around the world who are severely affected by the COVID-19 pandemic are asking their governments to bail them out. Virgin Australia wanted $1.4 billion from the Australian Government. Qantas claimed that if Virgin gets such a bail-out due to poor strategic planning, then it should receive $4.2 billion for good profit management.[3] This claim had nothing to do with needs, or that the $4.2 billion could be spent on boosting other essential industries and services.

Whilst not making a value judgement on the merits of any of the claimants for this $60 Billion ‘saving’; it must be remembered that Australia has lost a lot of its manufacturing base (and the expertise that goes with it), and needs Federal government support to be revitalized. This article makes a case for a large part of the JobKeeper savings be utilised to boost targeted manufacturing companies that have been shown to be important for our national security.[4]

Australia’s car industry that was once the backbone of manufacturing in Australia since 1925, now lost (along with its related know-how). Australia’s minerals are exported to other countries, especially China, to manufacture products and sell them back to us. Our wool is imported by China, not for its own consumption, but to value-add and export to the world. The list goes on. Our supply chains are dominated by very few countries; whose interests may vary from ours. Australia has been subjected to ‘bullying’ by being over-dependent on some countries that import large quantities from its agriculture and mining sectors.

Using JobKeeper Savings for Investing in Manufacturing Capability

Australia, like the USA, became a manufacturing powerhouse after World War II. However, manufacturing expertise and ingenuity was slowly eroded when cheap labour overseas, coupled with efficient global supply-chains, moved Australia’s manufacturing capability offshore to Asia in the 1980s and 1990s. Because of its high labour costs, Australia’s manufacturing businesses assumed they could not be competitive in manufacturing; but instead could just live off its service, education and financial sectors, cushioned by the worldwide demand for its staples in agriculture and mining.

This mindset has been confirmed by the latest Economic Complexity Index (ECI) published in October 2019 by the Kennedy School’s Center for International Development at Harvard University. The ECI exposes an under-appreciated truth about Australia; i.e. the enormous wealth generated by iron ore, coal, oil and gas, has masked an economy that has failed to develop the industries needed to sustain its position among the top ranks of the developed world.[5]

On the primary metric used in the database, i.e. an index of economic complexity, of a database of 133 economies, Australia fell from 57th to 93rd from 1995 to 2019, a decline that is accelerating. Australia’s top trading partner, China, rose from 51st to 19th over the same timeframe. The top 5 countries are Japan, Switzerland, Republic of Korea, Germany and Singapore. Australia is wedged between Senegal and Pakistan.

As the industrialist Sanjeev Gupta says, “Australia has had it far too easy for decades, relying on our resources sector to make it rich and largely abandoning manufacturing. Dig and load and be comfortable; it has not been forced to add any value, to create anything.”[6]

It must be remembered that manufacturing, although in a state of decline, is still a vital part of the Australian economy. It is Australia’s seventh largest industry for employment and sixth largest for output. It accounts for 11% of annual export earnings and employs close to one million people across 47,530 employing companies.[7]

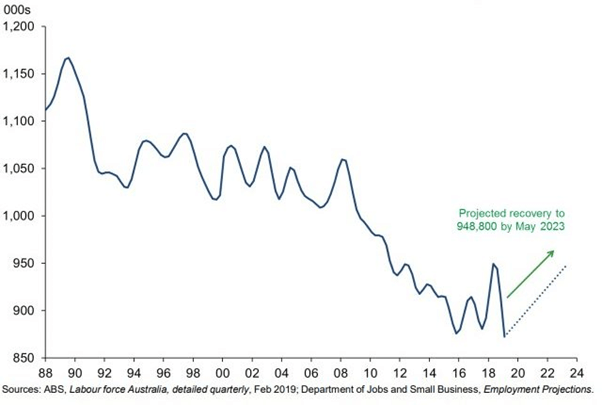

According to the ABS Labour Account data, the long-term decline in manufacturing employment was at its lowest in 2019; but was expected to abate over the next five years (Figure 1).[8] But that was before the COVID-19 pandemic.

Australian manufacturing has had many challenges over the past decade, including: the Global Financial Crisis; an extended period of relatively high exchange rates (which reduced from a high of 0.79 vis-à-vis the USD only from January 2018); the rapid rise of China as ‘the world’s factory’ and Australia’s largest trading partner; the end of local automotive assembly operations in 2017; the onset of digitalisation and ‘the fourth industrial revolution’; and large increases in local energy and other input costs.[9]

Skill-Level and Technology Intensity

Clearly, there is an urgent need in the longer term for Australia to expand from an economy that extracts and farms to one that adds value and manufactures complex things in a sustainable way. In the long-run, Australia needs to support advanced manufacturing, not just primary production. This means that Australian companies must manufacture complex products such as drones and robotics, renewable energy, processed food for export and the like, so they can scale up to become global powerhouses that can compete on quality, not on price. This article is focused, however, on Australia’s immediate manufacturing needs that need to be boosted for ensuring self-sufficiency in essential products.

Figure 1: Manufacturing Employment Trends

Figure 1: Manufacturing Employment Trends

The United Nations Conference on Trade and Development (UNCTAD) splits exports of manufactured goods into four categories, based on their level of skill and technology intensity:

- labour-intensive and resource-intensive manufactures;

- low-skill and low technology-intensive manufactures;

- medium-skill and medium technology-intensive manufacturers; and

- high skill and high technology-intensive manufactures.

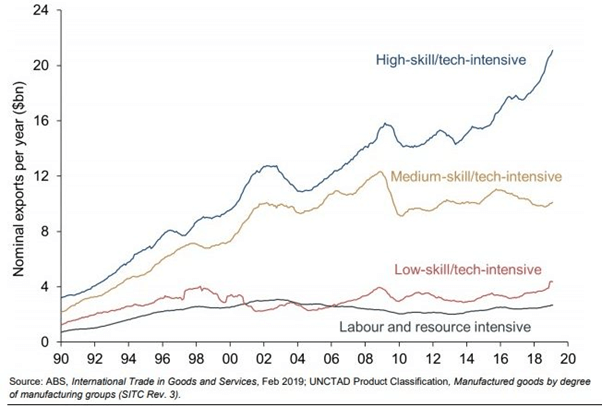

Applying this UNCTAD classification to ABS data suggests that in 2018, 55% of Australia’s exports of manufactured goods can be classified as ‘high skill and technology intensive’ and 27% can be classified as ‘medium-skill and technology-intensive’. Only 18% of manufactured goods exports were ‘labour and resource intensive’ or ‘low skill and technology intensive’ in 2018 (See Figure 2).

As one can see from Figure 2, over the past two decades, export earnings from labour intensive and low-skill exports have been relatively flat. This likely reflects intense global competition for these types of products and the progressive relocation of production to emerging and developing economies with lower labour costs. High labour costs in Australia have resulted in a comparative disadvantage in producing these types of homogenous, labour-intensive goods. Medium-skill and technology-intensive exports rose from 1998 to 2008 but have fallen since 2008. The sharp decline in early 2009 reflects declining exports of passenger cars, which are included by UNCTAD in this category. In contrast, export earnings from high-skill and technology-intensive manufactured goods have more than doubled over the past two decades. Between 2008 and 2015 high-skill and technology-intensive export earnings were relatively flat, probably reflecting the high Australian dollar during the mining investment boom. Since 2015 however, exports earnings from these goods have risen sharply, increasing by 7.3% in 2018 alone. Australia’s high-skill and technology-intensive exports in 2018 included medicaments, medicinal and pharmaceutical products, aircraft parts and aircraft equipment.[10]

Figure 2: Australian Manufacturing Exports by Skill-Level and Technology Intensity

Figure 2: Australian Manufacturing Exports by Skill-Level and Technology Intensity

As one can see from Figure 2, over the past two decades, export earnings from labour intensive and low-skill exports have been relatively flat. This likely reflects intense global competition for these types of products and the progressive relocation of production to emerging and developing economies with lower labour costs. High labour costs in Australia have resulted in a comparative disadvantage in producing these types of homogenous, labour-intensive goods. Medium-skill and technology-intensive exports rose from 1998 to 2008 but have fallen since 2008. The sharp decline in early 2009 reflects declining exports of passenger cars, which are included by UNCTAD in this category. In contrast, export earnings from high-skill and technology-intensive manufactured goods have more than doubled over the past two decades. Between 2008 and 2015 high-skill and technology-intensive export earnings were relatively flat, probably reflecting the high Australian dollar during the mining investment boom. Since 2015 however, exports earnings from these goods have risen sharply, increasing by 7.3% in 2018 alone. Australia’s high-skill and technology-intensive exports in 2018 included medicaments, medicinal and pharmaceutical products, aircraft parts and aircraft equipment.[10]

Whilst Australia’s manufacturing skill/intensity focus conforms to one of the most important concepts in economic theory, that of comparative advantage, the COVID-19 pandemic has shown up a major flaw in this foundational principle in the theory of international trade.

Comparative advantage is a fundamental tenet of the argument that all actors, at all times, can mutually benefit from cooperation and voluntary trade. But if trade between countries involuntarily ceases, even temporarily, as is what happened with the COVID-19 lockdowns, then high manufacturing skill/intensity countries are left without the basic essentials of living. These essentials are mostly produced by labour/resource-intensive and low-skill/technology-intensive manufactures. The outcome was that when China closed down, there was a run on toilet rolls in many high manufacturing skill/intensity countries!

Australia needs to regain our manufacturing capabilities in essentials. This does not mean that we have everyone working back on the farm or producing shoes and clothing in factories for 10% of today’s wages. It however means that the government must fund via subsidies, tax incentives and other levers, the manufacturing of essential goods. The Australian government has for years funded essential health services via its Medicare program. The medical doctors are not paid third-world salaries, as the government funds universal health care in Australia.

Whilst in the long-run Australia needs to invest in high-value, high wage industries such as high technology, pharmaceuticals and advanced manufacturing as discussed earlier; COVID-19 has opened our eyes that we also need to be self-sufficient in producing essential manufactured goods. These would be mainly what is required for day to day life such as processed foods; and those needed to protect our health-care system, such as respirators, ventilators and face masks. For example, the Australian Defence Forces were deployed to boost by at least tenfold the output of Med-Con, Australia’s only manufacturer of surgical masks, as a result of COVID-19 pandemic.[11] Some of the JobKeeper savings can be used to introduce more machines to its factory and increasing its workforce to cope with the demand.

Experts have warned of potentially deadly flaws in Australia’s medical supply chain. And as such, Federal and State funds are already flowing to boost the manufacturing of health-related products. For example, a consortium of 30 manufacturers formed the Grey Innovation consortium to come together to produce the components and assemble the ventilators by the end of July, issuing a plea to politicians: “Make Australia Make Again”. The consortium was awarded a $31.3 million contract by the Federal Government to build the ventilators, with the Victorian Government providing an additional $500,000 grant.[12]

Paraphrasing a famous quote “Give a man a fish and you feed him for a day. Teach him how to fish and you feed him for a lifetime” (Lao Tzu) – Australians should not be consuming, on a daily basis, overseas-sourced products; and instead learn once again how to make things ourselves, so that we need not be dependent on others for our essential manufactured goods.

I believe that the Australian federal government; must allocate much of its JobKeeper windfall saving of A$60 Billion in boosting domestic manufacturing; and put into place regulations and tax incentives that will encourage manufacturing innovation. These industries must also be protected from competition from products made with cheap labour in countries that have labour laws very different from our own.

The Role of Management Accountants

If Australia is contemplating boosting its manufacturing capabilities across all types of skills and technologies, this must go hand-in-hand with professionally qualified management accountants to provide reliable information for decision making. All organisations, especially manufacturers, need reliable cost information to take strategic decisions that will affect the future of their organisations. Such information is best provided by those who are professionally trained in strategic cost management.

Management accounting’s origin is cost accounting; which can be traced back to the industrial revolution. The idea was to help the businessmen to record and keep a track of their costs and expenses. These costs related to labour, materials, and other overhead costs directly attributable to a product or service. However, when industrialisation took off, these businesses had more ‘indirect costs’. These are costs that are not directly related to the production of goods or services. Allocating these indirect costs to the relevant products and services became of important to managers and owners for their decision making in product development, pricing and profitability. This was the origin of modern cost accounting.

In recent times, as manufacturing has become more complex with multiple lines of products and services, most costs are indirect costs. There are many methods to allocate such costs; and some traditional methods of allocation based on time and volume have been shown to provide widely inaccurate results that in turn lead to erroneous strategic decisions.

A financial audit of past transactions has very little decision information to make strategic decisions, especially if the past is very different to what the environment is going to be in the future. In a world of uncertainty, the one thing we are certain about is that the Post-COVID-19 business environment is going to be very different from anything experienced in the past. Yet, governments have placed statutory obligations on financial statement auditors in auditing the past; but cost auditors have no such statutory backing in auditing numbers that affect future performance.[13]

The implications of getting cost numbers wrong is staggering. Faulty costings result in faulty strategic decision making in pricing, quality, marketing, supply-chain, product mix etc.; which then have a flow on effect in many related industries. Going hand-in-hand with its investment in manufacturing capability, governments must also recognise the need for statutory strategic cost audits, to ensure that the resource allocations of government funds are made not only in the most strategic manner but also that value is created in a sustainable manner safeguarding the interests of the future generations.

#makeozmakeagain

The opinions in this article reflect those of the author and not necessarily that of the organisation or its executive

Article by

Prof Janek Ratnatunga

Professor Janek Ratnatunga is CEO of the Institute of Certified Management Accountants. He has held appointments at the University of Melbourne, Monash University and the Australian National University in Australia; and the Universities of Washington, Richmond and Rhode Island in the USA. Prior to his academic career he worked with KPMG.

[1] Michelle Grattan (2020), “Treasury revises Job Keeper’s cost down by massive $60 billion, sparking calls to widen eligibility”, The Conversation, May 22.

[2] A reporting error of that scale indicates a poor design of the form; which did not seem have some basic checks to ensure data consistency. For example, a simple ratio of revenue to number of employees would have uncovered this particular data input error where the money expected per employee ($1,500) was entered rather than the number of employees (1 employee).

[3] Mark Humphery-Jenner (2020), “7 reasons why a government bailout is not possible for Virgin Australia, Opinion, University of NSW Newsroom, 23 April. https://newsroom.unsw.edu.au/news/business-law/7-reasons-why-government-bailout-not-possible-virgin-australia

[4] Greg Bearup (2020), “Make Australia make again”, The Weekend Australian Magazine, May 23, https://www.theaustralian.com.au/weekend-australian-magazine/can-australian-manufacturing-become-great-again/news-story/4500599fff4a0750697cca36806fd9eb

[5] Harvard University (2019), Atlas of Economic Complexity, Kennedy School’s Center for International Development, October, https://atlas.cid.harvard.edu/

[6] Op. cit., Greg Bearup (2020).

[7] The Australian Industry Group Australian (2019) “Manufacturing in 2019 Local and Global Opportunities” AI Group Report, May, p.47. https://cdn.aigroup.com.au/Economic_Indicators/Economic_Outlook/Australian_Manufacturing_in_2019.pdf

[8] Australian Bureau of Statistics (2019), Labour Force Australia: Detailed Quarterly Employment Projections, Department of Jobs and Small Business, February, https://www.abs.gov.au/ausstats/abs@.nsf/mf/6202.0

[9] Op cit., The Australian Industry Group Australian (2019).

[10] Ibid.

[11] Katie Burgess (2020), “Coronavirus: The Australian army is being subbed in to help make face masks, Canberra times, March 17, https://www.canberratimes.com.au/story/6684074/the-australian-army-is-being-subbed-in-to-help-make-face-masks/

[12] Brett Mason (2020), “Manufacturers say ‘make Australia make again’ as experts warn of flaws in nation’s supply chain”, SBS News, April 13, https://www.sbs.com.au/news/manufacturers-say-make-australia-make-again-as-experts-warn-of-flaws-in-nation-s-supply-chain

[13] Only organisations of a certain size in India, Pakistan and Bangladesh are subjected to a statutory cost audit.