Certified Management Accountant (CMA) Program

Programme Description:

CMA Qualifying Workshop

The CMA is the flagship program of the ICMA. Upon completion, participants will have developed advanced skills of analysis, evaluation and synthesis in the areas of strategic cost and management accounting and business analysis; and, in the process, obtained an in-depth awareness of the current developments in the profession.

The programme can only be taken by a Graduate or Associate member of the Institute; or a student member who has met the pre-requisite entry requirements of the program.

The programme is not designed as one in which highly structured methods and rules are applied to various topics in order to find one “correct” solution or answer for problems or issues. Rather, it is more a possibilities quest, in which various controversial conceptual and practical issues will be reviewed and analysed, with due recognition to the reality of alternative value judgements. Given the history of recent developments in the profession and business practices, this approach to the study of the subject of strategic management accounting and business analysis is considered feasible and warranted.

Furthermore, evidence is available that in managerial accounting and business analysis, procedures continue to evolve and develop. Much of this dynamic activity is in response to changing business practices and policies and the complexity of modern firms.

Who should study for CMA Program ?

The programme can only be taken by a Graduate or Associate member of the Institute; or a student member who has met the pre-requisite entry requirements of the program.

Subjects to be taken – Both subjects

Duration – Seven Days (Qualifying Workshop)

Qualified Accountants

If you are a qualified accountant from an accounting body acceptable to the institute.

Graduate in Finance

If you have a Degree in finance and accounting from a university acceptable to the institute.

Graduate Management Accountants

If you are a Graduate/Professional who completed the CMA Graduate Conversion Programme or the complete Graduate Management Accountant Programme.

How is the qualification structured?

ICMA Qualifying Workshop comprises of two post-graduate level subjects, delivered in the form of a Seven Day programme and is compulsory for those who are seeking Certified Management Accountant (Australia) Membership.

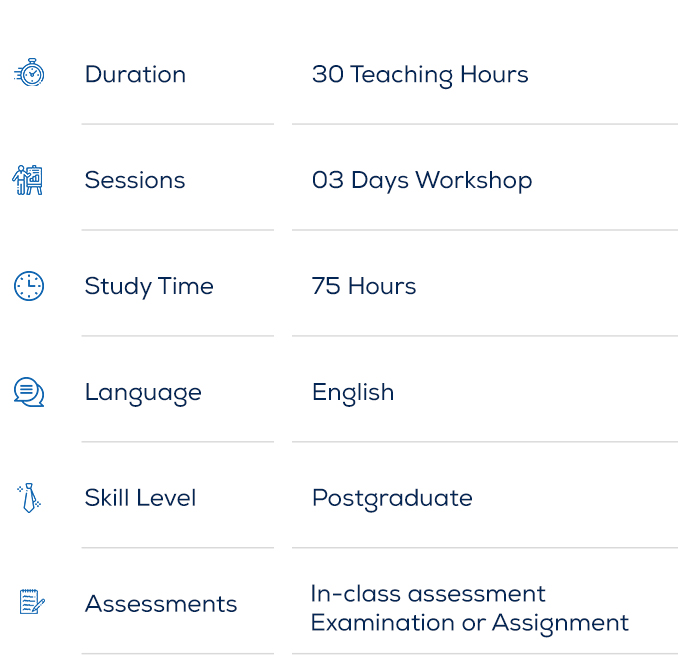

- Module 1 – Strategic Cost Management (SCM) – Three days

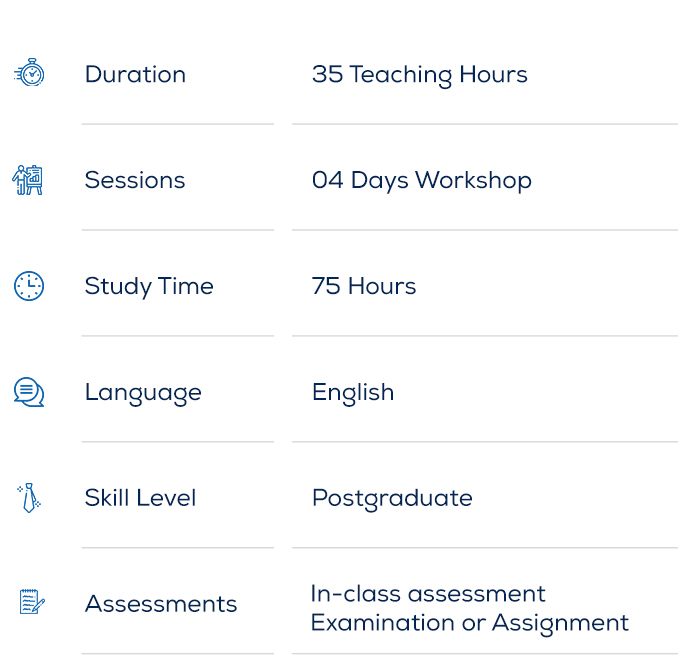

- Module 2 – Strategic Business Analysis (SBA) – Four days

How is the assessment structured?

Those who wish to apply for CMA (Australia) Membership are required to complete the following assessments based on their professional experience, within two years after completing the workshop.

- Candidates with more than 20 years of experience – Case Studies during the modules.

- Candidates with 10 to 20 years of experience – Case Studies during the modules and submission of an Assignment.

- Candidates with 5 to 10 years of experience – Case Studies during the modules and open book examinations of three hours for each module.

- Candidates with less than 5 years of experience – Need to wait until you complete the minimum 5 year professional experience requirement.

Simply send us your details, we will get back to you with more information.

CMA Australia Workshop is available to the candidates who have completed the ICMA Graduate Conversion Programme, Qualified Accountants or candidates with a Degree or a Masters in Finance and Accounting acceptable to ICMA Australia.

Just call us, our programme coordinators will guide you through!

Executive Summary

On completion of this subject students should have developed skills of analysis, evaluation and synthesis in cost and management accounting and, in the process, create an awareness of current developments and issue in the area. The subject covers the complex modern industrial organisations within which the various facets of decision-making and controlling operations take place; the subject includes discussion of costing systems and activity based costing, activity management, and implementation issues in modern costing systems.

Synopsis

- Identify the basic conventions and doctrines of managerial and cost accounting and other generally accepted principles which may be applied in the contemporary cost management models.

- Identify major contemporary issues that have emerged in managerial accounting.

- Discuss a number of issues relating to the design and implementation of cost management models in modern firms.

August 30, 31 & September 1 – 2025

September 20, 21, 22 – 2025 at Hotel Gall Face

Executive Summary

On completion of this subject students should have developed skills of analysis, evaluation and synthesis in cost and management accounting and, in the process, create an awareness of current developments and issue in the area. The subject covers the complex modern industrial organisations within which the various facets of decision-making and controlling operations take place; the subject includes discussion of costing systems and activity based costing, activity management, and implementation issues in modern costing systems.

Synopsis

- Identify the basic conventions and doctrines of managerial and cost accounting and other generally accepted principles which may be strategically applied across the various functions of a business organisation.

- Identify major contemporary issues that have emerged in strategic management accounting.

- Discuss a number of cost and management accounting issues relating to the design and implementation of strategic, marketing, strategic value and other management models in modern firms.

- To appreciate the management accountant’s role in the implementation of cost management systems for marketing decision making.