Auditors to the Slaughter: Why Audit Opinions are ‘Untrue’ and ‘Unfair’

Sometimes you may get what you wished for, but it could turn out to be a can of worms!

In my CEO message a year ago, in August 2018, in an article titled “Silence of the Auditors”, I called for a Royal Commission into Regulation, Independence, Politics, Production and Knowledge Base of Auditors. I said that an independent inquiry into the role of auditing, especially of financial institutions, would help to highlight the shortcomings of the current practices; i.e. whilst all the Banks were marched like lambs to the slaughter, to sheepishly admit their significant ethical and moral shortcomings in the Banking Royal Commission, those who audited these financial institutions appeared to have escaped scot-free.

This was taken up by the media,[i] and there were numerous comments posted online, some agreeing with my recommendations and others questioning the costs of the changes that were being proposed. One even questioned if I had enough professional experience in auditing to make such a drastic recommendation.[ii] [Full Disclosure: prior to my academic and consulting career, I was a chartered accountant with KPMG, and undertook numerous audits including subsidiaries of Unilever and British American Tobacco].

Now a scandal at National Australia Bank (NAB), one of Australia’s Big-4 banks, has triggered unanimous bipartisan support for a parliamentary inquiry that will start later this year into the potential conflicts of the big audit firms. It is not quite the Royal Commission that I (and others) had called for, but such an inquiry is welcome, and long overdue.

The current NAB scandal erupted when a treasure-trove of leaked documents was handed to the Australian newspapers (The Age and The Sydney Morning Herald) by a whistle-blower that shone an embarrassing light on the private workings of the bank and the cosy relationship it had with its auditor of 13 years, Ernst & Young (EY). The leaked documents included confidential minutes of a meeting where NAB’s chairman Ken Henry privately told EY consultants in the midst of the Royal Commission of the Banking and Financial sector that he was “confident” the bank was still selling products that ripped off its customers and would eventually trigger compensation. The documents make for disturbing reading.[iii]

As bad as this all is, the leaks go far deeper than just the problems at NAB, and the enormous challenges it faces in its lax systems. They raise questions about the cosy relationship between audit firms and their clients.

The external audit is supposed to be a ‘trust’ mechanism installed to persuade the public that capitalist corporations and management are not corrupt and that companies and their directors are made accountable. In an uncertain world, corporate audits are expected to produce comfort by reassuring the stakeholders that there has been an external and objective check on the way in which the financial statements have been prepared and presented, and it is an essential part of the checks and balances required. Accountants, as auditors, have cemented their status and privileges on the basis of claims that their expertise enables them to mediate uncertainty and construct independent, objective, true, and fair accounts of corporate affairs. This expertise, it is claimed, enables markets, investors, employees, citizens, and the state to limit and manage risks.[iv]

But an “Audit” is also big business. Auditors collect large amounts in audit and non-audit fees. In the past decade the Big-4 auditing firms earned more than $1 billion from the big four banks in auditing and non-auditing fees. EY, for example, earned $286 million from NAB in audit and non-audit fees in the decade 2008-2018. In the same period, ANZ paid their auditor KPMG $203 million, Commonwealth bank paid PwC 330 million and Westpac paid PwC 248.5 million.[v]

The need to hold auditors accountable have been highlighted in many countries, but after a few weeks of media exposure, largely ignored. For example, in 2014, more than one in three audits inspected by the U.S. government’s audit watchdog were so deficient that it was stated that the auditors should not have signed off on them.[vi] Then about the same time, a more damning report[vii] compiled by the International Forum of Independent Audit Regulators (IFIAR), an organisation representing audit regulators of 49 jurisdictions, including Australia, France, Germany, Italy, Japan Spain, UK and the US, stated categorically that:

“…there are persistent deficiencies in critical audit areas relating to audit work on the controls within companies designed to prevent abuses, valuation of assets and liabilities, and disclosures of crucial information to the public.” (IFIAR, 2015).

Of particular interest to Australia is that the report was also concerned that auditors of financial institutions pay inadequate attention to the likelihood of losses and the valuation of investments and securities. In the financial services sector, it seems an independent report is whatever the client’s money can buy.[viii]

The IFIAR report was compiled from the audit inspections carried out by national regulators and focuses on audits of major listed companies; which are dominated by the Big-4 accountancy firms – Deloittes, EY, KPMG and PwC – and smaller rivals such as Grant Thornton and BDO. Their combined global revenue is around US$150 billion.

The standard response to any criticism from the auditing industry is to deny the problem or issue new auditing standards, audit reports, codes of ethics and promise tougher action against laggards. But none of these solutions are adequate, as they are all based on a tweaking of accounting standards.

If the tweaking of accounting standards is the solution, then who controls the body responsible for issuing these standards in the first place? Most informed CEOs know that the International Financial Reporting Standards (IFRS) are issued by the IFRS Foundation and the International Accounting Standards Board (IASB). But what most CEOs, and an overwhelming majority of non-accounting regulators do not know, is that the big accounting firms have a complete control over the deliberations at the IFRS Foundation and at the IASB, as they stack the Board and thus effectively control the development, production and modification of accounting and auditing standards. As a result, although there are numerous international auditing standards, exposure drafts, codes and related pronouncements – that cover about 5,000 pages – they remain curiously silent on auditor accountability to the public.

Consequently, although the public bears the cost of audits and audit failures, it has no right to see audit files or to make an assessment of the quality of audit work. It is only when a whistle-blower leaks documents, such as in the case of the NAB scandal referred to above, are we privy to what goes on behind the scenes. It is not pretty.

There is currently as Australian Parliamentary inquiry into the potential conflicts of the big audit firm (to report in 2020). If this inquiry results in an admission of negligence by auditing firms, they will still escape liability, because under most jurisdictions, they do not owe a “duty of care” to any individual shareholder, creditor, employee, superannuation (pension) scheme member, or any others affected by their negligence.

In many Western economies, the “too big to close” syndrome continues to prevent effective regulatory retribution. However, in India, under Section 140 of its Companies Act, PwC was banned in early 2018 from auditing listed companies in India for two years after being accused of negligence in its audit work at the now defunct Satyam Computer Services. The Securities and Exchange Board of India said that Price Waterhouse chose to rely on “glaring anomalies” and huge differences in Satyam’s balance confirmations during its audit work between 2001 and 2008. Although the initial ban did not include ongoing 2017/18 audits for listed companies, the date was extended into 2019, and PwC was allowed to carry on auditing its clients until 31 March, 2019.[ix] In a very recent development, Indian regulators are now pushing for a five-year ban on Deloitte and KPMG over allegations the firms helped conceal bad loans at Infrastructure Leasing & Financial Services, a major infrastructure and finance group whose default last year triggered a credit crisis.[x]

What Exactly is the Audit Report Telling Us About the Company?

The audit report of financial statements uses the term ‘True and Fair’ to express the condition that financial statements are truly prepared and fairly presented in accordance with the prescribed accounting standards. As such, an unqualified audit opinion of the financial statements states that the audited financial statements are true and fair view in all material respect; i.e. after the auditors performed their audit, they found no material misstatements in the financial statements and that financial statements are correctly prepared.

They do not attest that the value of the company as stated in the financial statements (called book value) is true and fair; nor do they attest that the financial transaction recorded arose out of only ethical practices; and they do not attest that there has been no fraud.[xi] They only attest that the financial reports are prepared and presented in accordance with the prescribed accounting standards. And who develops and issues those accounting standards? The Auditors themselves!

Using a university analogy, it’s like the Big-4 are setting the subject syllabus, preparing the exam paper, writing the answers to the exam and finally giving a grade. If there is a complaint, they are the adjudicators of the quality of their own work!

It is time for an independent body, such as Parliament, to be responsible for setting accounting standards.

What is Left Out of the Audit Report?

The Audit Report is flawed because the underlying Generally Accepted Accounting Principles (GAAP) and the resultant International Financial Reporting Standards (IFRS) are flawed.

In a paper titled the Accounting Delusion: Faith and Trust in IFRS Reports[xii], it was stated that the financial statements prepared and audited in today’s economic environment can be traced to the industrial era, or the age of the corporation (about 1850), when tangible assets such as machinery were the engines of growth. In this era, financial accountants endorsed or invented rules based on the historical cost doctrine that yielded values which had no counterparts in commercial reality – often book valuations, which may have been relevant at time of acquisition, were sheer fictions or delusions in terms of value, on reporting dates many years later.

‘Delusion – A false belief strongly held in spite of invalidating evidence.’

The delusion has been perpetuated in recent times by (1) the vagueness of the rules and principles on which the accounting framework is based (2) the drive for global consistency in accounting standard resulting in the loss of relevance in local applicability; and (3) the difficulties of verifiability resulting in intangible assets such as an organisation’s brand equity, intellectual capital and reputation being kept off balance sheet. This has resulted today in knowledge-economy companies reporting book values widely divergent of prorate-market values; i.e. the financial statement valuations of today’s organisation are even more fictitious than ever before. These values in financial reports are then audited, with the auditors (who are remunerated by the preparers of the statements, supposedly on behalf of the shareholders of the company), often holding that the prepared statements give a true and fair view of the state of affairs of the company.

Why Audit Reports are Meaningless and Fictitious

Let me take the three major reasons why the application of IFRS results in flawed financial statements, and consequently why they result in meaningless and fictitious audit reports.

- IFRS estimates the value of all assets on the company’s books, if sold on a piece-meal basis.

- IFRS is silent on how intangible assets can be shown in the financial statements.

- Ignoring intangible assets has resulted in widely divergent shareholder values (equity values); i.e. the equity value of what the stock market says the company is worth (called market value) is for most companies widely different to what the audited financial statements say is the company’s value (called book value).

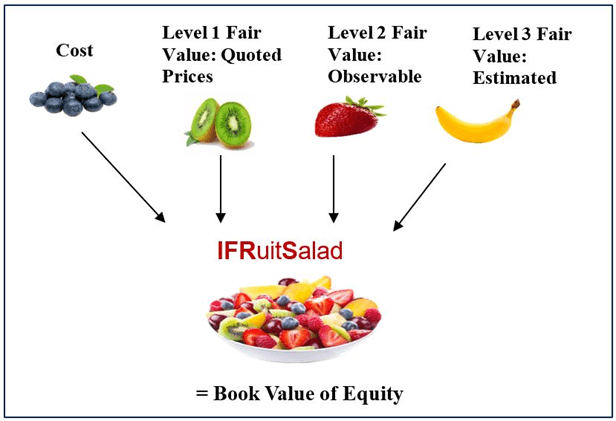

The first major flaw in the financial statements is that IFRS estimates the value of all assets on the company’s books, if sold on a piece-meal basis. These values can be at ‘cost’ or ‘fair value’ depending on the purpose for which the asset is held.[xiii] As a result, some assets and liabilities in the Balance Sheet can be at “Cost”; whilst other assets and liabilities in the same Balance Sheet can be at “Fair Value”. This mismatch of asset valuations is then compounded because “Fair value” itself can have three levels – called the ‘Fair Value Hierarchy’:

- Level 1 fair values are the best because these are based on quoted prices in active markets for identical assets or liabilities at the measurement date.

- Level 2 fair values are observable for the asset or liability, either directly or indirectly.

- Level 3 values are unobservable for the asset or liability, so estimates and variables are used to plug into valuation models.

Individual assets or liabilities valued using one of these valuation approaches are then added to arrive at an entity’s “book value”. This end-result is a mathematically meaningless figure (like adding grapes, kiwi fruits, strawberries and bananas). The result is the ‘Book Value” which is more akin to IFRuitSalad.

One simple fix to this IFRuitSalad problem is not to add all assets and liabilities on a piece-meal basis and call it book value, but instead to report these under 4 separate valuation hierarchies, i.e. (1) Cost Value; (2) Level 1 Fair Value; (3) Level 2 Fair Value and (3) Level 3 Fair Value. At least then the readers of the financial statements will know how these asset values have been arrived at.

The second reason why the application of IFRS results in flawed financial statements is that IFRS is mostly silent on the issue of intangible assets. An intangible asset is an asset that is not physical in nature. Goodwill, brand recognition and intellectual property, such as patents, trademarks, and copyrights, are all intangible assets. Google’s ‘search algorithms’ and Facebook’s ‘social media power’ are good examples of intangible assets. These do not appear in those two company’s financial statements. However, the stock market places significant value on these (non-reported) intangible assets.

Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory. Additionally, financial assets such as stocks and bonds, which derive their value from contractual claims, are considered tangible assets. Google’s and Facebook have comparatively very little tangible assets. Organisations such as Airbnb (the world’s largest hotel company) have almost no tangible assets.

Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory. Additionally, financial assets such as stocks and bonds, which derive their value from contractual claims, are considered tangible assets. Google’s and Facebook have comparatively very little tangible assets. Organisations such as Airbnb (the world’s largest hotel company) have almost no tangible assets.

Intangible assets are recognized by IFRS only if there is an arms-length transaction that brings their value into existence at a particular date. For example, if Google was to purchase Airbnb, it will do so at market value, and suddenly all of Airbnb’s intangible assets will be brought to the balance sheet as Goodwill. The market, however, does not wait for such third-part transactions to occur.

Whilst there are many difficulties in estimating the fair-value value of tangible assets[xiv], it is almost impossible to do so with most intangible assets, as many of these cannot be sold on a piece-meal basis and thus do not even fit into Level 3 of the Fair Value Hierarchy. Further, often intangible assts are intertwined with tangible assets, which gives rise to ‘capabilities’ (what a company can do) which can have quite different values to its assets (what a company owns); which make fair-value value impossible to estimate for just the tangible asset.[xv] As a result, financial statements that are based on IFRS virtually ignore intangible assets, and thus are unable to value the income generating capability of the assets working as a whole in a going-concern.

This results in the third major problem with IFRS reports. Ignoring intangible assets has resulted in widely divergent shareholder values (equity values) between what the stock market says the company is worth (called market value) and what the audited financial statements say is the company’s value (called book value).

For example, the book value of Microsoft on June 29, 2018 was $82.72 billion, and market value (share price times number of shares) was $768.56 billion (more than 9-times of book value of the company). Similarly, Walmart had a book value of $77.87 billion; and its market value was $320.866 billion (4-times book value). The auditors of both companies said that their book valuations were ‘true and fair’, when they have got it wrong 900% and 400% respectively!

Clearly, it is easier for a camel to go through the eye of a needle than for a book value to reconcile with a market value. Even in tangible asset heavy companies book values and market values differ significantly. The difference is attributed to several factors, including the company’s operating model, its industrial sector, the nature of a company’s assets and liabilities, and the company’s specific attributes.

A simple fix to this problem is to bring into the books the difference between book value and market value as ‘Unrealised intangible asset values’ on balance sheet date. One criticism of this simple fix is that it is common to see even large-cap stocks moving 3 to 5 percent up or down during a day’s session. Such variations are nothing compared to the 400-900% variation between market values and book values.

It is not in the interest of the accounting and auditing profession to perpetuate this delusion of a true and fair view. The financial accounting and auditing professions need to rethink the accounting model to fit the new informational requirements of a knowledge economy. Of specific interest in rethinking such reports would be the recognition and measurement of intangible asset and closing the gap between market values and book values. Only then can a proper audit be conducted.

Strategic Audit

As I have said many times before, it is time that management accountants further distance themselves from the financial accounting and auditing profession and ensure that they are able to be inculcate good strategic governance and strategic audit practices in the organisations that they work in.[xvi]

What is needed is a statutory audit of expected future performance and how it affects current value, and not an audit of past performance and fair-value of individual assets. Such audits are called ‘Strategic Audits’. Since businesses are behaving badly in the (legal but often unethical) pursuit of higher profits and shareholder value, the key is for the government to legislate that companies undertake compulsory strategic audits to evaluate business practices beyond simply the financial reporting of the past. Key business practises in marketing, advertising, supply-chain, manufacturing, human resource management and information technology need be strategically audited to ensure that brand reputation and shareholder value is “future-proofed” against such rampant bad behaviour by corporates, their compliant financial auditors.

A strategic audit provides an objective view of the growth and exit options available to shareholders and management when difficult and important decisions need to be made in order to maximise shareholder value. The result of a strategic audit is to ensure that there is a well-defined and agreed path of development, including a series of practical steps which when implemented will substantially enhance the value of a company. A strategic audit is far different from the common perception of financial audits. It is a continuous evaluation of all the strategic functions of any success-seeking firm. Numerous components (e.g. stakeholder audit, customer satisfaction audit, etc.) make up the totality of the strategic audit, although the scope of each component audit will vary depending on the organisation.

Many will be concerned that this will significantly increase audit costs. This will not be the case if the scope of the traditional statutory financial audit is restricted to reporting if transactions are correctly recorded and the financial statements are prepared and fairly presented in accordance with the Historical Cost Doctrine and Generally Accepted Accounting Principles (GAAP). The need to estimate and report that the addition of all fair-value of individual assets (less liabilities) will give an accurate reflection of the state of affairs of the company is totally flawed as most intangible assets are left out, and capability values completely ignored. It is anyway not be necessary as this valuation is given efficiently by the market at any point in time.

Such a limitation of scope will significantly reduce the financial audit costs. It may even eliminate the need for an annual statutory audit; as today financial technology (FinTech) and regulation technology (RegTech) combined with basic machine learning can ensure this is done on a real-time basis.[xvii] The savings can be directed towards undertaking strategic audits, specifically tailored to an organisation. Most shareholders will want strategic auditors to perform, at a minimum: (a) stakeholder audits; (b) information security audits; (c) environmental audits; (d) corporate ethics audits and (e) leadership audits.

Many firms invest heavily in their brand reputation, to signal that they can be trusted. The greater the likelihood that bad behaviour will be exposed and made public, the more companies will do to guard against such behaviours that significantly diminish brand reputation. Alongside hefty fines, a statutory strategic audit, alongside strong whistle-blower protection, will increase the chance of bad behaviour being exposed and fined, and their executives sent to jail.

The opinions in this article reflect those of the author and not necessarily that of the organisation or its executive.

No Company (or Auditor) should be “Too Big to Jail”.

Article by

Prof Janek Ratnatunga

Professor Janek Ratnatunga is CEO of the Institute of Certified Management Accountants. He has held appointments at the University of Melbourne, Monash University and the Australian National University in Australia; and the Universities of Washington, Richmond and Rhode Island in the USA. Prior to his academic career he worked with KPMG.

References:

[i] Adam Zuchetti (2018), “Should Auditors and Liquidators Face a Royal Commission?”, My Business, 30 August,

[ii] Business Reporter (2018), “Royal Commission into Audit Floated by Accounting Body”, Accountants Daily, 30 August

[iii] Adele Ferguson (2019), “Time’s Up for Henry but Also the Billion-Dollar Audit Club”, The Age, August 3, page 8.

[iv] Janek Ratnatunga (2018), “Silence of the Auditors, On Target, July-August, pp.3-6.

[v] Adele Ferguson, (2019), “Time’s Up…” page 8.

[vi] Emily Chasan (2014), “One in Three Audits Fail, PCAOB Chief Auditor Says”, Wall Street Journal, Jan 24.

[vii] IFIAR (2015), “2014 Annual Report and Accounts, International Forum of Independent Audit Regulators (IFIAR).

[ix] Business Today (2018), “PwC To Complete Audits Taken on This Calendar Year, But Ban to Continue”, Business Today, January 19.

[x] Stephanie Findlay (2019), “India Pushes For 5-year Auditing Ban for Deloitte and KPMG Arm”, Financial Times, Delhi, June 12.

[xi] The audit firms get into trouble only if they are caught concealing fraud, as in the Indian allegations against Deloitte and KPMG.

[xii] Janek Ratnatunga (2016),”The Accounting Delusion: Faith and Trust in IFRS Reports” Journal of Applied Management Accounting Research, June 21.

[xiii] See case study on ‘purpose’ in, Janek Ratnatunga (2015), “Audit Opinions for Sale?” On Target, Nov-Dec, Vol 19, No. 6, pp. 5-6.

[xiv] Often companies turn to external valuers, who are paid by the company, to give an ‘opinion’ as to the value. Such ‘opinions’, given by the likes of Dunn and Bradstreet on sub-prime mortgages ultimately turned out to be highly flawed, and resulted in the Global financial Crisis of 2008.

[xv] Janek Ratnatunga, Norman Gray and Kashi Balachandran (2004) “CEVITATM: The Valuation and Reporting of Strategic Capabilities”, Management Accounting Research, March, 15(1): 77-105.

[xvi] Janek Ratnatunga (2018), “Management Accountants are not Accountants!”, On Target, April 20.

[xvii] Janek Ratnatunga (2019), “The Rise and Rise of RegTech: Does it spell the End of the Annual Audit?”, On Target, March