05 Reasons – Why Engineers Should Study Finance?

Engineers are making decisions all the time, in multiple ways. Having a good financial understanding guides these decisions better.

Even if an engineer remains as an individual contributor as opposed to going into management, experienced engineers often become thought leaders in their organizations, involved in project priorities and strategic direction.

But when engineers do move up the management chain, financial understanding becomes critical. Portfolio mix, gross margin, and pricing are all elements that have to come together to have a sustainable and growing business.

Here are five examples where engineers, or engineering managers, can benefit by good financial understanding.

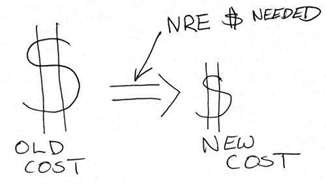

- Is it worth it to spend money to design and engineer a low-cost part?

This is a typical scenario many engineers face. A new part can be created with an NRE (Non-Recurring Engineering) investment that saves X dollars per unit. The math is pretty simple. What is the total savings over the lifetime of the product, and will the savings exceed the investment? If not, forget it. But even if it does, there is more analysis. You may have many opportunities — how do you rank your best ones? My favorite method is Break Even time. How long does it take to break even on the original investment? Your unit volume and savings will allow you to calculate the equivalent time. Shorter times mean faster returns. Choose these first.

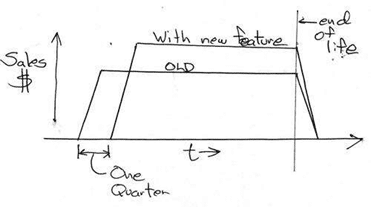

- Is it worth it to delay a project by a quarter to add a feature to increase sales?

Delaying a project introduction is one of the costliest changes an organization can make. But sometimes you have no choice, or the reason is compelling. If you delay by a quarter, how much is it costing you? A lot.

Delaying a project introduction is one of the costliest changes an organization can make. But sometimes you have no choice, or the reason is compelling. If you delay by a quarter, how much is it costing you? A lot.

In general a one quarter delay means a loss of all the gross profit (gross margin × revenue) of mature sales for an entire quarter. Even though the delay occurs at the beginning of product availability, it is actually a quarter of peak sales that is lost, since the death of the product is defined by the marketplace, and is fixed. Here’s how I would look at it. Calculate the increased gross profit over the original lifetime due to increased sales volume. Then subtract an entire quarter of the new gross profit. Ouch. Typically it’s not worth it, particularly since you may have the opportunity to add the feature later anyway.

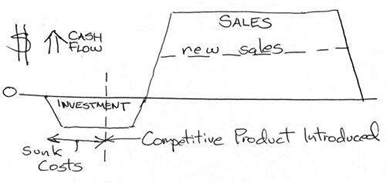

- A competitor has introduced a product that is expected to reduce a new project’s sales by half. Should I continue or cancel the project? I’ve already sunk a big investment into it, but there is more to complete the project. With such a big investment already, should I continue?

Here’s the rule. Ignore sunk costs. Look at only future costs and future returns, but look at them honestly. Anything you already spent is money spent in all scenarios, and can be ignored when comparing the two choices you now have: to keep going or to cancel the project. You can use your normal financial methods to see if it makes the cut or not when compared against alternatives, but not including the sunk costs. In general, projects near completion will be completed because the incremental costs to do so are low, but those projects just ramping up should be sternly evaluated and possibly canceled.

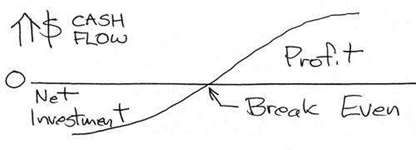

- I’m in a startup business where the investors are anxious that we achieve break-even as soon as possible. What is the optimum pricing strategy?

Pricing is one of the greatest levers a company has on profit. While many people believe gross margin reflects manufacturing efficiency (it does), it is equally driven by price of the product. After all, one dollar of increased price is one dollar of increased gross margin (actually, gross profit), and with fixed expenses, one dollar of increased operating profit.

Pricing is one of the greatest levers a company has on profit. While many people believe gross margin reflects manufacturing efficiency (it does), it is equally driven by price of the product. After all, one dollar of increased price is one dollar of increased gross margin (actually, gross profit), and with fixed expenses, one dollar of increased operating profit.

Let’s think this through. The organization has fixed operating expenses. It is the total gross profit (all the revenue minus manufacturing costs) that funds these operating expenses. If it exceeds those, the organization has achieved break-even and made a profit. Therefore, in pure financial terms, it is best to price a product to maximize the total gross profit. That is in total dollars, not percentage. Here’s the deal.

If you increase the price, the sales will drop. That is the sales elasticity. You will also increase the amount of gross profit per unit. If you can estimate the elasticity and you know the actual manufacturing cost, you can derive a price that maximizes gross profit dollars and helps achieve break-even for the investors the quickest.

- We are doing a strategic review, and have ten great product ideas. Some are small projects, some are large. We can’t fund them all. Finance has calculated NPV (Net Present Value) and ROI (Return on Investment) for each. Which should we use as our prime factor for prioritizing which projects we pursue and which we don’t?

NPV essentially measures return minus cost, while ROI measures return divided by cost. I’ve simplified this a lot, as both discount the time value of money. Essentially, NPV is the absolute value of a project, while ROI is a ratio.

Of course, the world is complex, and projects may be interrelated. I’m ignoring that for now. On a pure financial view, which method of prioritization delivers the most value for the corporation?

By Larry Desjardin

Adapted from EE Times Online Version

About Institute

The Institute of Certified Management Accountants (Australia) was incorporated in 1996 with the objectives of providing a professional organization for management accountants, and to encourage, disseminate and promote the specialisation in organizations in Australia and overseas. CMA Australia Qualification was introduced to Sri Lanka by the Institute of Chartered Accountants of Sri Lanka in 1999. The Academy of Finance has been appointed as the exclusive partner in Sri Lanka since 2006.

Programme Overview

There are four stages in the ICMA Graduate Management Accountant programme, with four subjects in each stage. Stage Four of the graduate program has multiple graduate, professional and postgraduate entry points is considered as the Graduate Conversion Programme. Candidates will be required to complete up to four subjects in different combinations depending on the entry qualification.

Programme Content

- Financial Modelling – Building financial models with Excel with an insight to financial accounting

- Management Accounting – Comprehensive course in management accounting theory and practice

- Financial Management – Financial mathematics, instruments, project evaluations and valuaation.

- Financial Statement Analysis – Deeper insight to financial statement analysis with numbers and beyond numbers.

Simply send us your details, we will get back to you with more information.

The complete qualification you will have to complete up to four subjects of the Graduate Conversion Programme depending on your current qualification/s.

Financial Modeling

- Accounting for Managers: An Introduction

- The Accounting cycle 1 : Journals and ledgers

- The Accounting Cycle 2 : Balance day Adjustments, Descriptions

- The Accounting Cycle 3 Financial statements

- Company Accounts

- Financial Statement Analysis : An Introduction

- Accounting for Product Costing

- Profitability Planning

- Budgeting

- Financial Mathematics

- Capital Budgeting : Investment Decision Models

- Working Capital Management

Excel for Managers: pre readers (Before course starts)

Financial Statement Analysis

- The Demand for Financial Statement Information

- The Supply for Financial Statement Information

- Basic Techniques in Financial Statement Analysis

- Financial statement Numbers: Empirical and methodology issues

- The Impact of Accounting Policy Alternative on Financial Statement Analysis

- Cross – Sectional Analysis of Financial Statement Information

- Time – Series Models and the analysis of financial Statement Information

- Capital Markets and Corporate Disclosure

- Corporate Distress Analysis

- Corporate Distress Analysis – Multivariate Analysis

- Debt Rating, Lending Decision and corporate financial Statements

- Valuation and forecasting

Financial Management

- Fundamental Concepts of Financial Mathematics

- Introduction to the Theory of valuation

- Portfolio Returns and Risks

- Capital Asset Pricing Model

- Efficient Markets Theory

- Dividend Policy

- Bond Yields and Bond Pricing

- Introduction to Capital Markets and Funding Sources

- Evaluation and Selection of Capital Investment Projects

- Estimating project cash flows

- Capital Budgeting

- Cost of Capital

Management Accounting

- Management Accounting Basic Terms and Concept

- Cost Categories and Cost Volume Profit Analysis

- Product Costing

- Cost Allocation

- Budgeting

- Standard Cost Analysis

- Activity Based Techniques

- Relevant Costing for Decision Making

- Responsibility Centers and transfer pricing

- Performance Evaluation

- Inventory Management Quality Control